When you form a Tribe, you're starting a business. It's important to understand the cost of ownership that comes with running your investing business.

Your Tribevest subscription fee covers our platform - which gives you access to a transparent dashboard with a fully-functional business bank account, operating agreement, contributions, funding rounds, motions, voting, cap table, document storage, and more.

But before you can get to the fun of organizing and operating your investor business, you’ll need to keep in mind the cost.

Getting all this together on your own can be time consuming and expensive. That's the primary reason our Founder, Travis Smith, created Tribevest.

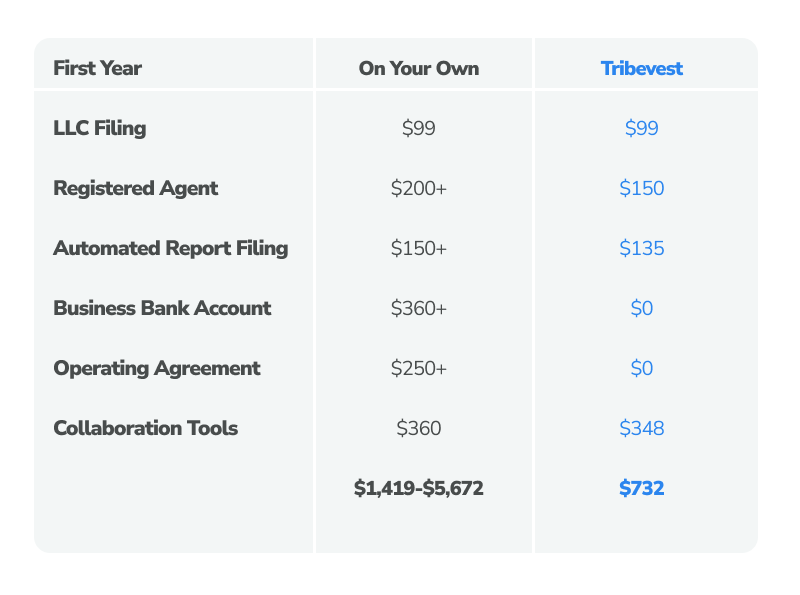

Let’s break down the cost to form your multi-member LLC in the state of Ohio for the first year.

LLC Filing

It’s best practice to form an LLC to protect your personal assets and get tax advantages and you will need to file an LLC through Tribevest or bring your own to start a Tribe. LLC filing fees vary based on state, costing about $40-$500+. You can file your LLC through Tribevest in any of the 50 states. We recommend Ohio because although we are Buckeyes at heart, Ohio is a business friendly filing state with its $99 filing fee, quick turnaround time, and no annual tax.

LLC Compliance

You will need to maintain compliance with your LLC state with a Registered Agent and Report Filing. The registered agent can be an individual or entity designated by the LLC to receive service of process notices, government correspondence, and compliance-related documents. This fee is usually a few hundred dollars - Tribevest can be your registered agent for $150 for the first year and $198 for additional years.

Annual report filing requirements vary from state to state and they can be time consuming and complex. To take the pressure off, you’ll likely want to have an entity submit the required report filing for you. This fee is usually a few hundred dollars - Tribevest offers Automated Report Filing for $135 per year.

Business Bank Account

Upon your LLC being filed, Tribevest will open a business bank account for your Tribe within minutes! This is at no additional cost to you, it’s included in your Tribevest subscription fee. This is a full-service business bank account including a debit card, ACH and wire transfer, and everyone in your Tribe will be able to see transactions.

Operating Agreement

To protect yourself and your members, you’ll want to create and sign an operating agreement. You may choose to hire an attorney or third party to assist you in setting up your operating agreement. The cost here will again vary greatly, however, the average hourly rate to hire a business lawyer runs between $250-350.

Collaboration Tools

Communication and alignment are essential for running an investment group properly. Unless your entire investment group lives under one roof (and perhaps even then!) you’ll need to invest in some collaboration tools to keep everyone in the loop. Phone calls, text chains, and email threads won’t cut it: You’ll need a more robust tool where you can share ideas, documents, and more. A tool like Slack can run around $30/month. Or use Tribevest to organize specifically around your investor group for $29/month.

It's important to understand the cost that comes with starting an investor group. You are creating a business which is exciting! Luckily, in most cases, these costs are tax deductible.

On your own, it can cost thousands of dollars and a lot of time and headaches. Tribevest provides a cost effective and efficient solution to formalize your investor group so you can invest with confidence.